tucson sales tax rate change

Effective July 01 2003 the tax rate increased to 600. Tumacacori AZ Sales Tax Rate.

What Is Illinois Car Sales Tax

On July 15 2019 the Mayor and the Council of the City of South Tucson.

. Tucson Sales Tax Rate Change. The 2022 tax lien sale will be online only. The attached pdf contains the most recent changes to City Code Chapter 11 related to tax rates and license fees.

2022 List of Arizona Local Sales Tax Rates. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Average Sales Tax With Local.

11518 to authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86. New 2022 threshold amounts for the retail sales and use tax two-level tax rate structure as approved by Phoenix voters with Proposition 104 in the August 25 2015 city elections will go into effect January 1 2022.

Mayor and Council adopted Ordinance No. Recently Mayor and Council passed Ordinances Nos. TUCSON AZ Tucson News Now - Tucson residents have decided that the city will increase its sales tax rate by 12 percent to help pay for road repair and public safety.

Tumacacori-Carmen AZ Sales Tax Rate. Tumacacori az sales tax rate. The Tucson City Council passed the increase in part because it was facing a 43 million deficit at the beginning of the fiscal year which.

SE FWD change trim Avg. The citys 2 tax rate applies. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725.

Effective July 01 2009 the per room per night surcharge will be 2. The Arizona state sales tax rate is 56 and the. The increase will bring in an estimated 37 million in the coming year to the city coffers.

That would raise it from 81 percent to 86 percent-. Arizona has 511 special sales tax jurisdictions with local sales taxes in. To help equip police and firefighters and repair more roads the city wants voters to add a half cent to the sales tax.

Arizona sales tax rate change and sales tax rule tracker. Tucson Estates AZ Sales Tax Rate. From 45 to 55.

Groceries and prescription drugs are exempt from the Arizona sales tax. The decision on Monday night raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. Always consult your local government tax offices for the latest official.

The December 2020 total local sales tax rate was also 8700. Review Arizona state city and county sales tax changes. Tucson AZ Sales Tax Rate.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax. Effective October 1 2016 the following rate increases take effect in South Tucson.

As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits. From 45 to 55. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower.

Has been received by the tax collector. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most. From 45 to 55.

Arizona has recent rate changes Wed Jan 01 2020. Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. A 1500 refrigerator purchased in Marana where the sales.

Effective July 01 2016 the per room per night surcharge will be 4. Effective October 1 2019. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53.

There is no applicable special tax. If you have additional questions or concerns about this change please contact Tax. 11703 and 11720 which make big changes to Tucson City Code Chapter 7 Article XIX dealing with Tobacco Retail Establishments.

Sales Tax Breakdown. If Tucson voters approve the proposed temporary half-cent sales tax increase city officials say it would mean 100 million for road repairs and 150 million for public safety improvements. The current total local sales tax rate in Tucson AZ is 8700.

2016 Hyundai Tucson AWD 4dr 20L Premium AWD MAGS from wwwhyundaicertifiedca. The current total local sales tax rate in tucson az is 8700. City of South Tucson Tax Code effective 10-01-2019 150 KB Summary of Proposed Modified Fees draft 04-29-2019 for eff.

You can print a. 19-01 to increase the following tax rates. Click the sales tax you want to edit.

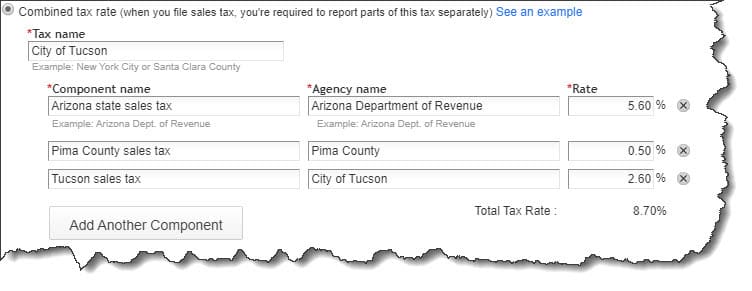

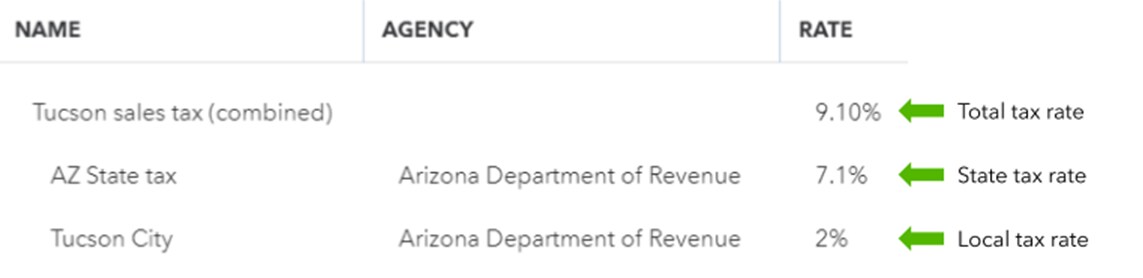

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. History of Rate Changes. There are a total of 80 local tax jurisdictions across the state.

City of Tucson NOTICE TO TAXPAYERS TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018. About 30 people in the audience. Select the Arizona city from the list of cities starting with T below to see its current sales tax rate.

Tusayan AZ Sales Tax. The following are the tax rate changes effective February 1 2018 and expiring January. The sales tax jurisdiction name is Arizona which may refer to a local government division.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. CITY OF SOUTH TUCSON. Changes Regarding Retail Tobacco Sales and Sales of Vaping Supplies.

Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. Prop 101 was the only item on the ballot for the special election that ended Tuesday May 16 but voters have been sending in ballots for weeks. Tucson Code Section 19-1301 is repealed effective January 01 2015.

The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege Use Tax Rate Look Up opens a new window page to find tax rates by address or map. TUCSON AZ Tucson News Now - Tucsons hotel tax surcharge doubles on July 1 from 2 a night to 4 a night.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

State And Local Taxes In Arizona Lexology

How To Charge Sales Tax Vat With Samcart Samcart

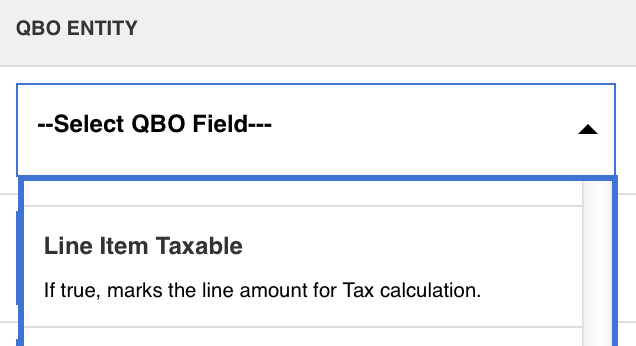

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

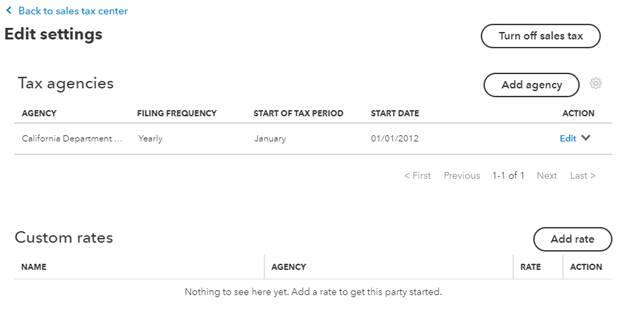

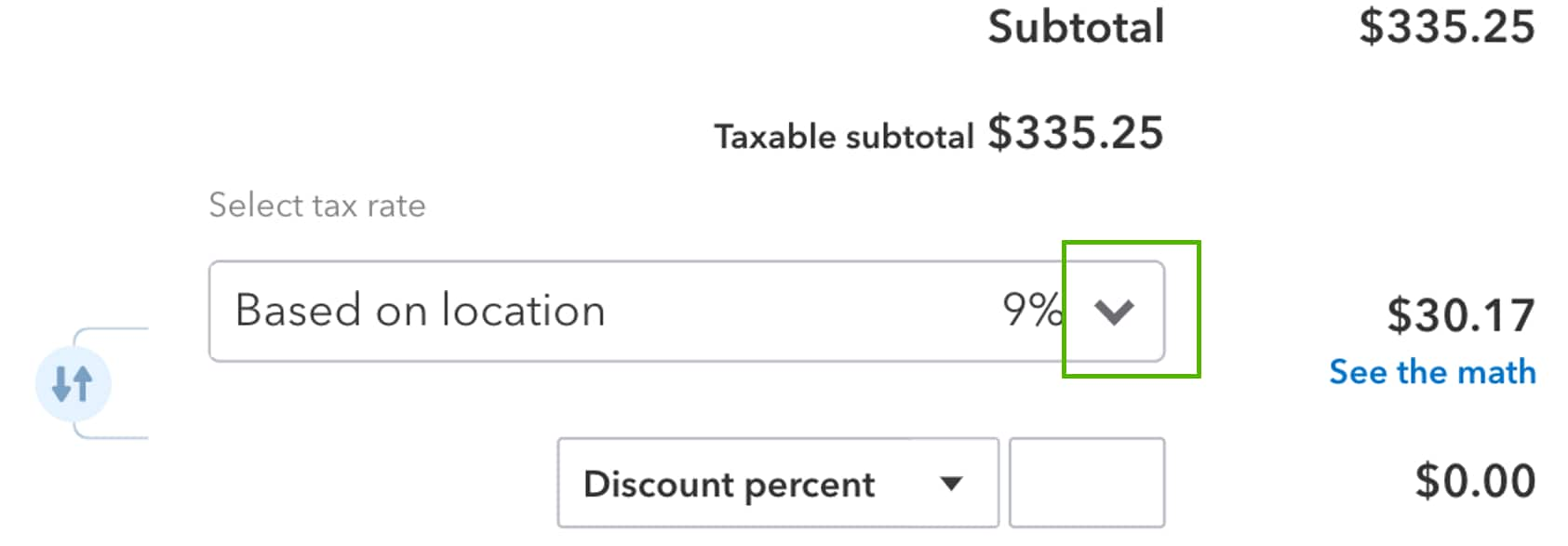

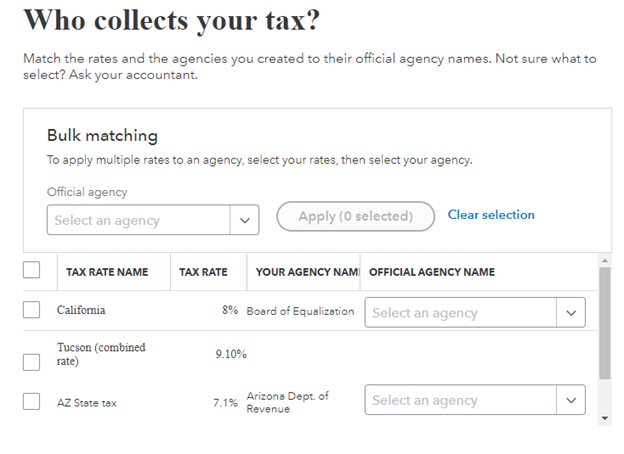

How To Process Sales Tax In Quickbooks Online

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Property Taxes In Arizona Lexology

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

How To Process Sales Tax In Quickbooks Online

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

5 Things You Need To Know About Sales Tax In Quickbooks Online

Pin By Linnell King Edwards On Andy Braun Loan Officer Flyers Home Buying Paying Off Mortgage Faster Finance Plan

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts